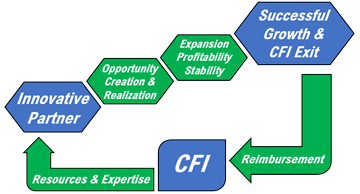

Our investment strategy centers around supporting the development of renewable energy, efficiency, and cleantech which generate substantial and predictable revenues. At Zahren Funds, we are focused on continuing to provide catalytic project capital to our partners, in combination with strategic support in order to accelerate growth and facilitate long-term financial success. We aim to meet the needs of project developers by offering flexible resources and critical solutions which allow our partners to reach their full potential.

Investment Approach

Cleaner Footprint. Better Planet.

Investment Process

- We seek to partner with smaller companies who have capable, experienced management teams that have identified clear opportunities for expansion.

- We are open to collaboration with innovative start-ups and developing entities that can demonstrate substantial potential for growth.

- Zahren Funds negotiates creative financing agreements and performs due diligence, while continuously monitoring partner’s financial and operational activities.

- Our typical investment size ranges from $1 million to $10 million. We seek investments that produce quarterly cash flows and therefore do not usually provide venture capital. We typically target project investment terms of 2 to 12 years with our preference for 3 to 7-year terms domiciled in North America.

- Several of our prior successful investments have been initiated with a small investment followed by a larger addition of capital as our portfolio companies grow and have additional financing needs.

Demonstrated Success

- Between 2013 and 2015, CFI I invested $8 million of project equity with Stem, Inc., a growing developer of efficient energy storage systems.

- CFI I’s investment helped Stem overcome capital obstacles which had slowed the implementation of their innovative battery storage technology.

- As a result, Stem achieved rapid expansion and now manages more than 860 energy storage systems in addition to a project finance pool exceeding $650 million.

- Stem was publicly listed on the NYSE in a business combination with Star Peak Energy ‘STPK’ in 2021. The merger closed on 4/28/21 and the company is now listed as ‘STEM’.